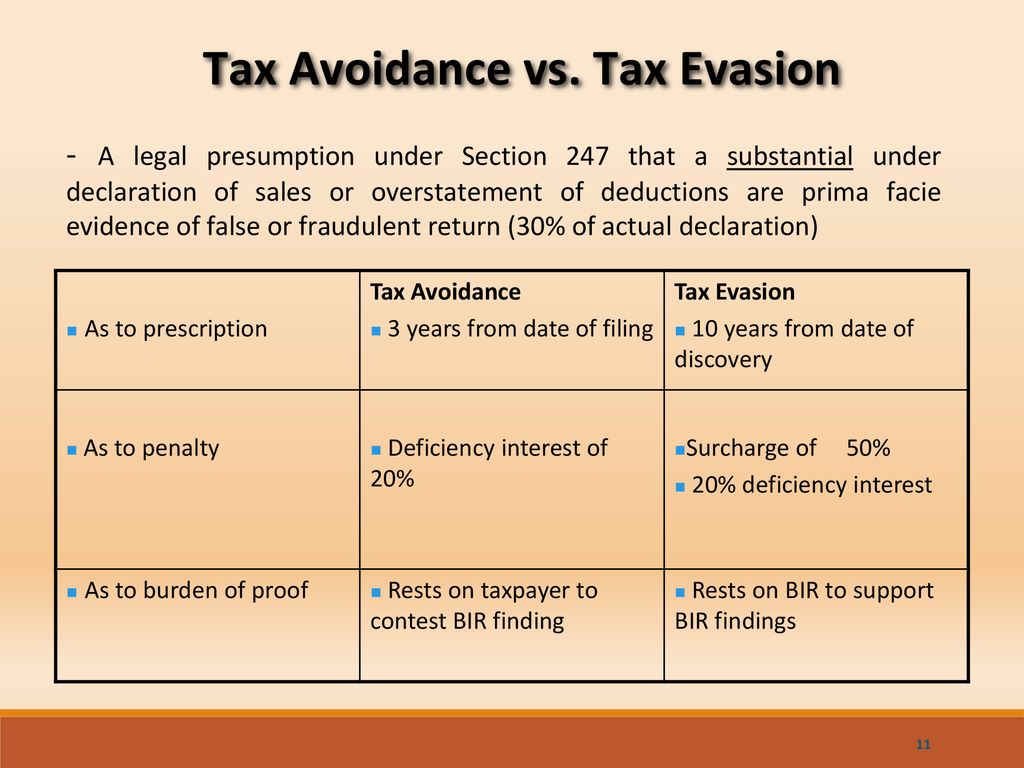

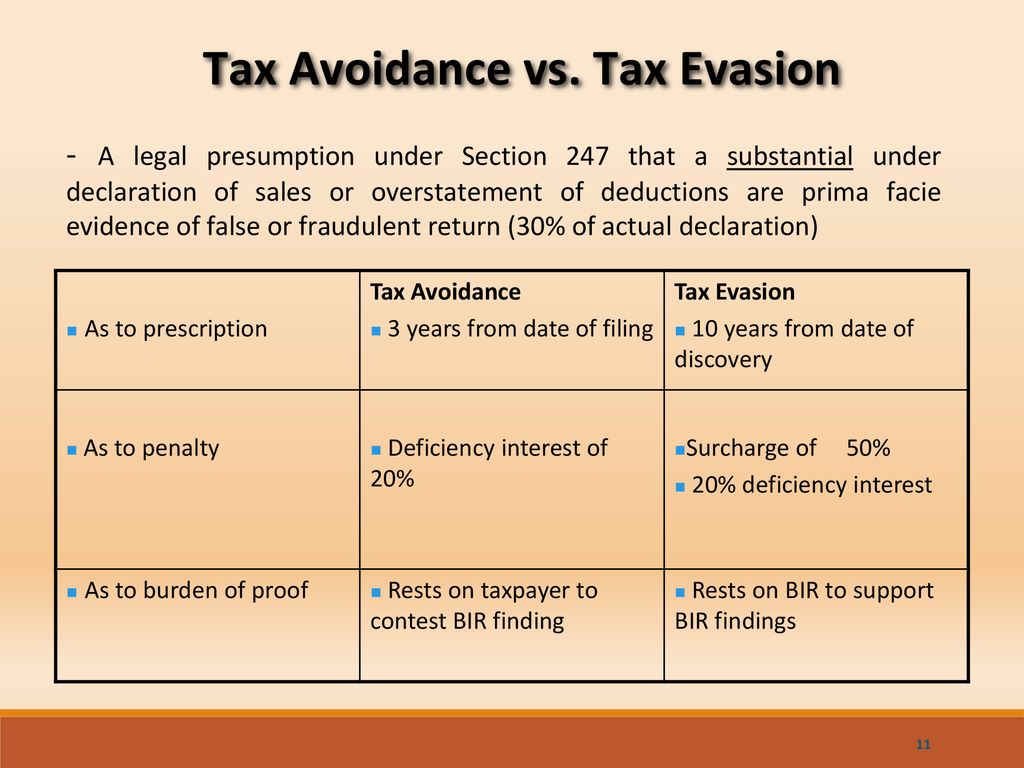

tax avoidance vs tax evasion philippines

Basically tax avoidance is legal while tax evasion is not. Tax avoidance and tax evasion are the two most common ways used by taxpayers to not pay taxes or pay reduced taxes.

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

The difference between tax avoidance and tax evasion essentially comes down to legality.

. It involves the acts of not paying or underpaying ones taxes often by making deliberate false declarations. The difference between tax evasion vs tax avoidance is tax evasion is illegal while tax avoidance is unethical. Important Tax-related Documents You Need to Keep.

The Philippines has concluded several tax treaties to avoid double taxation and prevent tax evasion with respect to taxes on income. By Euney Marie Mata-Perez on November 18 2021. The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts.

Tax evasion occurs when the taxpayer either evades assessment or evades payment. Dont know san yung. Tax evasion is the use of illegal means to avoid paying your taxes.

Moreover tax evaders may face other punishments that include. Some Major Differences Between Tax Evasion and Tax Avoidance. The distinction between tax evasion and tax avoidance to a great extent comes down to two components.

In tax avoidance youre making use of your tax benefits to lower taxes for your small business. Tax avoidance is the. This penalty can sometimes be up to 75 percent of the taxes owed along with the tax balance itself.

Tax evasion is an illegal act punishable by law. Avoiding tax is legal but it is easy for the former to become the latter. November 18 2021.

Tax avoidance aka tax minimization is a way taxpayers minimize their taxes through legally permissible means meaning it is not punishable by law. Tax Avoidance Vs Tax Evasion Philippines. On 16 Feb 2022.

8 Best Practices for Lowering Your Taxes in the Philippines. Tax avoidance is organizing your undertakings with the goal. Tax July 1 2022 arnold.

This is entirely different from tax evasion which is. What is Tax Planning. Tax avoidance are unethical since it attempts to manipulate the system without inflicting any harm.

There are currently 31 Philippine tax. Tax Avoidance Vs Tax Evasion Philippines. Tax Evasion vs.

The biggest difference between the two is that tax avoidance is completely legal. The difference between tax avoidance and tax evasion boils down to the element of concealing. Delaying or postponing the sale of a.

Tax avoidance and tax evasion are the two most common ways used by taxpayers to not pay taxes or pay reduced taxes. In tax avoidance you structure your affairs to.

How To Reduce Your Tax Legally And Ethically Ppt Download

Estimating International Tax Evasion By Individuals

Mon Abrea Tax Evasion Vs Tax Avoidance Do You Want To Make Sure You Re Doing The Right Thing Visit Www Sealofhonesty Ph Now Facebook

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

Investopedia Video Tax Avoidance Vs Tax Evasion Youtube

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Opinion Bongbong S Tax Evasion Karma

Concept Of Tax Evasion Tax Avoidance Definition And Differences

What Is The Difference Between Tax Evasion And Tax Avoidance

The Philippines Is A President S Worst Nightmare The Society Of Honor By Joe America

What Are Tax Evasion And Tax Avoidance Taxes 101 Easy Peasy Finance For Kids And Beginners Youtube

Tax Evasion Vs Tax Avoidance Biron Law